Sep 3rd 2019, 11:08

Blog 3rd September 2019

In this week’s blog, I preview the spending review and refer to: Sajid Javid, Boris Johnson, Education, Health, Police, Housing, Local Government, Local Government Association, County Councils’ Network, Local Government Chronicle, Brexit, Resolution Foundation, Office for Budgetary Responsibility, Institute for Fiscal Studies, Hertfordshire County Council, Sunday Times, Financial Times, Seminars and Training.

Clouds gathering over the Houses of Parliament where Sajid Javid will present the 2019 spending review

Sajid Javid, the Chancellor of the Exchequer, will present his spending review tomorrow (4th September). However, Boris Johnson, the Prime Minister, has already made a series of spending announcements and speculation is rife that a general election may be imminent.

The spending review will only cover a single year and is expected to include increased public expenditure and reduced taxation that will be funded from increased borrowing. In my view this reflects very poor financial management on the part of the government. I discussed this aspect of the situation in my blog on 12th August. To view this blog, please click here.

Boris Johnson has announced measures for increased spending on education, health and the police. These proposals are expected to require about £6billion of additional spending and borrowing in 2020/21, with the largest proportion being for reversing cuts to per-pupil funding in schools. Additional health spending of £1.8billion and the employment of 20,000 police officers have also been proposed. He told the ‘Sunday Times’ that the Spending Review would be the:

“Biggest, most generous spending review since the height of Tony Blair’s New Labour”

I have commented on the proposals for health and the police in previous blogs.

In my blog of 22 August, I comment on the government’s proposals for the police. To view this blog, please click here.

In my blog of 5 August. I comment on the government’s proposals for health. To view this blog, please click here.

It has been suggested that local government budgets may be increased by up to £3.5billion. It is interesting to note that there are already several temporary specific grants for local government in the budget for 2020/21 that total £3.5billion. These include the improved better care fund; the winter pressures grant and the social care support grant. The Local Government Chronicle reports that the Treasury was unable to confirm whether the newly announced funding would replace or add to these grants, raising questions over not only the level of money being made available, but also what formula would determine the size of the slice and whether the conditions which accompanied these grants continue.

Councillor David Williams (Conservative, Hertfordshire County Council), the Chair-elect of the County Council’s Network has pointed out that, while a continuation of these grants would at least provide some welcome stability, a rolled over funding level and an increase in council tax of 3% would have still leave councils with a funding shortfall of £5.2billion.

Critics say that any increases in public expenditure would not be enough to reverse the cuts that have been imposed since 2010 and that some departments could still miss out. Spending on justice, local government services and 16-18 further education are all now about 20% below 2010 levels.

For example, the additional £700million that has been announced for SEND services falls short of the £1billion that the Local Government Association has calculated is needed to meet the shortfall in 2020/21.

There are fears that some services may face reduced budgets, with the Financial Times reporting that:

“Housing and defence are among those likely to face a tough settlement”.

Some analysts suggest that affordable housing budgets may be reduced, while the more optimistic are suggesting that local authority housing capital receipts could be localised.

Boris Johnson has also promised tax reductions that would mainly benefit wealthier people. However, it is expected that the government will wait for a full budget to reveal specific details here.

The economy is weakening. It recorded negative growth in the second quarter, and public borrowing has increased. If Britain leaves the European Union without a ‘deal’ at the end of October a serious economic shock is expected. Interest rates are already very low. It could therefore be argued that the government should increase public expenditure and reduce taxes to maintain demand in the economy, but this does represent a departure from the approach to economics that has traditionally characterised Conservative governments.

The Resolution Foundation has calculated that government borrowing in 2020/21 will be about £5billion higher than the Office for Budgetary Responsibility predicted in March 2019.

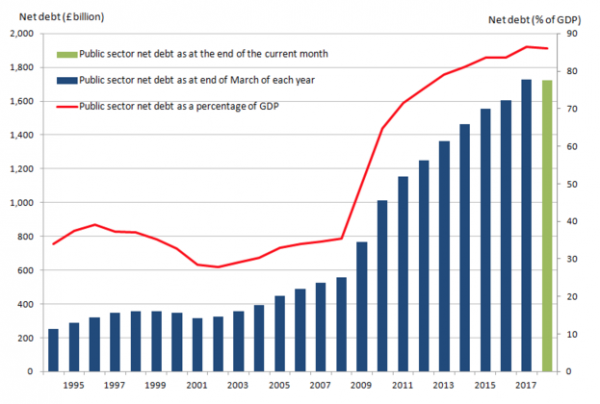

United Kingdom Government Borrowing since 1994

Government borrowing is already very high, has increased and is increasing. Economists consider that Sajid Javid risks breaking the government’s commitment not to raise public borrowing above limits set out in the Conservative manifesto that are for public debt to fall as a proportion of Gross Domestic Product and to ensure borrowing, adjusted for the state of the economy, is below 2% of Gross Domestic Product in 2020/21. The government is also committed to bring the public finances into balance by the mid-2020s – a promise economists say will be almost impossible to keep.

The government is also taking risks by making spending commitments without updated guidance from the Office for Budget Responsibility. Paul Johnson, Director of the Institute for Fiscal Studies told the ‘Guardian’ that:

“Making big fiscal announcements in a period of great economic uncertainty means we will have little idea how sustainable or costly decisions made this week will be. The risks are exacerbated by not having up-to-date forecasts from the Office for Budgetary Responsibility.”

According to recent analysis by the Office for Budgetary Responsibility, even a relatively benign ‘no deal Brexit’ scenario would push the United Kingdom economy into recession, make the United Kingdom permanently poorer and result in higher borrowing of £30billion a year from 2020/21 onwards. If this happens there would be doubts about the solvency of the United Kingdom government and the sustainability of existing levels of public expenditure.

I intend to write a briefing paper on the spending review and its implications for public services. If you would like to be notified when this is available, please contact me at Adrian.waite@awics.co.uk

Our seminar on ‘All You Want to Know about Welsh Local Authority Housing Finance’ will be held in Cardiff on 22nd October 2019. This is a very useful introduction and overview of this very important subject. For further information or to make a booking, please click here.

Our seminar on ‘All You Want to Know about English Local Authority Housing Finance’ will be held in London on 5th November 2019. This is a very useful introduction and overview of this very important subject. For further information or to make a booking, please click here.