Oct 10th 2019, 18:01

Blog 10th October 2019

In this week’s blog, I refer to: Brexit, Institute for Fiscal Studies, BBC, European Union, Bank of England, United Kingdom Government, Conservative Party, Boris Johnson, Public Works Loans Board, Local Government Association, Eden District Council, Councillor Judith Derbyshire, Risk Management, Training.

The Institute for Fiscal Studies has published an interesting report entitled ‘United Kingdom economic outlook in four Brexit scenarios’. It hit the headlines because of its predictions that ‘Brexit’ will lead to a significant increase in public sector debt, with the BBC thundering that ‘No-deal Brexit would push United Kingdom debt to fifty-year high’.

Key findings include:

In the event of a ‘No Deal Brexit’ the Institute for Fiscal Studies assumes that the United Kingdom government would introduce a reflationary budget that would be designed to increase demand in the economy. This would include:

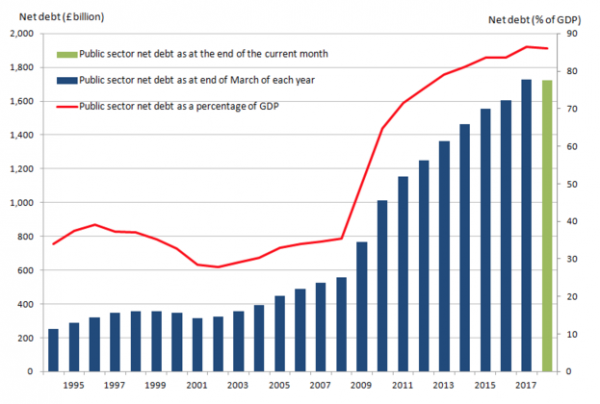

Graph showing the increase in UK Government Debt since 2008.

United Kingdom government debt has ballooned since 2008 and the government is still borrowing more. The report forecasts that government borrowing would increase from the planned £50billion a year to £100billion a year, the equivalent of 4% of Gross Domestic Product and twice the limit on public borrowing that has been set by HM Treasury.

The Institute for Fiscal Studies concludes that:

“The government is in practice operating with no effective fiscal rules at present,”

Boris Johnson, the Prime Minister, has said he wants to raise the threshold for the top income tax rate from £50,000 to £80,000 that it is estimated would cost the United Kingdom government £8billion in tax revenues each year.

Paul Johnson, Director of the Institute for Fiscal Studies, said on the release of the report that:

“The government is now adrift without any effective fiscal anchor. Given the extraordinary level of uncertainty and risks facing the economy and public finances, it should not be looking to offer further permanent overall tax giveaways in any forthcoming Budget.

“In the case of a no-deal Brexit, though, it should be implementing carefully targeted and temporary tax cuts and spending increases where it can effectively support the economy.”

So, it appears to me that, for public services, a ‘No-Deal Brexit’ may result in a short-term increase in funding as the government attempts to sustain demand in the economy. However, in the longer-term, reduced growth, higher debt and a need to reduce taxes to align with the United States and the third world would be likely to result in significant reductions in funding for public services that might make the years of ‘austerity’ look like a time of plenty!

To view or download a copy of the Institute for Fiscal Studies report, please click here.

Meanwhile, in a surprise move, the Public Works Loans Board has increased the rates of interest that it charges local authorities on their loans. The Board will now charge local authorities an interest rate that is 1.8% above its own costs of borrowing rather than 0.8%. The reason is that local authorities have been increasing their borrowing during recent months and is combined with a new limit of £95billion on how much is available to lend, so is presumably designed to discourage further borrowing. The Local Government Association has calculated that the increase could add £70million to councils' borrowing costs in 2020/21. A spokesperson said that:

“It presents a real risk that capital schemes, including vital council house building projects, will cease to be affordable and may have to be cancelled as a result.”

Penrith Town Hall where Eden District Council is based.

Eden District Council in Cumbria has launched a ‘Warm Homes Eden’ service that is designed to help people who struggle to keep themselves warm. It is an energy efficiency scheme that came from Eden’s Affordable Warmth Partnership working together. Cumbria Action for Sustainability delivers Warm Homes Eden for the Affordable Warmth Partnership. It offers:

The scheme is targeted at vulnerable people and those with modest means.

At the launch, Councillor Judith Derbyshire (Liberal-Democrat), Housing & Health Portfolio Holder at the Council said that:

“Eden District Council is delighted to be working with other agencies, by both jointly funding and delivering this Warm Homes Eden project. The project is designed to help residents to save money on their heating and make their homes warmer. Offering an energy efficiency service for low income households is a key objective for Eden District Council because we have such a pre-dominance of solid wall properties, which can be hard to heat. Two thirds of the district is not connected to the mains gas network and reliant on other more expensive forms of heating.”

Further information is available on the Eden District Council website at: https://www.eden.gov.uk/housing/housing-support-and-grants/warm-homes-eden/

Our seminar on ‘All You Want to Know about Risk Management in Local Government and Housing’ will be held in Leeds and London during November and December 2019. This is a very useful introduction and overview of this very important subject.

For further information or to make a booking, please click here.