Oct 8th 2018, 16:27

Blog 8th October 2018

In this week’s blog, I refer to: Local Authority Housing Finance; Theresa May; Conservative Party conference; Local Government Association; Lord Gary Porter; Ministry for Housing, Communities & Local Government; HM Treasury; Inside Housing; Philip Hammond; Budget 2018; Right to Buy; Appleby Town Council; Seminars & Training.

I am writing this blog on the train as I travel to London in advance of our seminar on ‘Developments in Local Authority Housing Finance’.

One very recent development that I will be covering is the announcement made by Theresa May at the Conservative Party Conference that the ‘cap’ on local authority borrowing to support council housing development is to be abolished. Her statement came as a surprise and was as follows:

“The last time Britain was building enough homes – half a century ago- local councils made a big contribution. But something is still holding many of them back. There is a government cap on how much they can borrow against their Housing Revenue Account assets to fund new developments. Solving the housing crisis is the biggest domestic policy challenge of our generation. It doesn’t make sense to stop councils from playing their part in solving it. So today I can announce that we are scrapping that cap.”

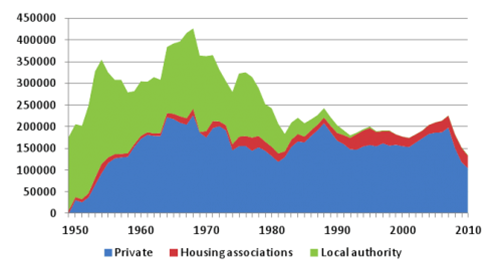

Graph showing that 300,000 homes a year were built only between 1953 and 1979 when there were significant council house building programmes

Further information was provided to 'Inside Housing' by ‘a number ten source’ who said that:

“There would be no limits placed on the amounts councils could borrow, with the amount of borrowing contingent only on how many use it… The government expects this figure to be around £1billion a year, but this depends on take-up… Councils will not be required to bid for the power to borrow.”

The sector has reacted with unbounded joy amidst calculations by gleeful consultants that this could result in councils building an additional 100,000 new homes. Lord Gary Porter, the Leader of South Holland District Council and Chair of the Local Government Association, predicted that the change would be made within months and said that:

“It is fantastic that the government has accepted our long-standing call to scrap the housing borrowing cap.”

However, I would advise caution because:

The only thing that I think is certain is that the government is making up housing policy ‘on the hoof’ and that can’t be a good thing. I tend to believe that if something sounds too good to be true it probably isn’t true. I would be delighted if the ‘borrowing cap’ was abolished but I think some of the celebrations may be a bit premature.

Reading between the lines, I suspect that what may emerge is a policy that allows councils to use housing revenue account resources to support borrowing to fund mixed tenure developments in which social housing will represent only a small proportion of the stock. This would be consistent with Lord Gary Porter’s comments and would provide more homes in total than the 60,000 social homes that the Local Government Association calculated that the policy would deliver. It would also help to maintain demand in a Brexit-induced recession and help to reverse the decline in home-ownership – both objectives that are important to the government.

However, many in the sector would not welcome the lifting of the ‘borrowing cap’ in this way.

The other big issue that local authorities often raise with government is whether ‘right to buy’ should be discontinued to protect the social housing stock. This wasn’t mentioned at the Conservative conference. Can we expect Philip Hammond to announce this as part of his budget next month? I think not!

Our next seminar is: ‘All You Want to Know about Local Authority Housing Finance’ and will be held in London on 6th November 2018. As usual, this seminar is proving popular, but we still have a few places available.

This seminar is designed to give an introduction and overview to this important subject and is fully up to date with all developments. It is designed for people who are not experts in housing finance, but who need to understand the basics and achieve an overview of what is going on. It is suitable for councillors, housing managers, tenant representatives, finance staff who have limited experience of local authority housing finance and others who realise that an understanding of housing finance can place them at an advantage!

The session will answer the following questions:

For more information or to make a booking, please click here.

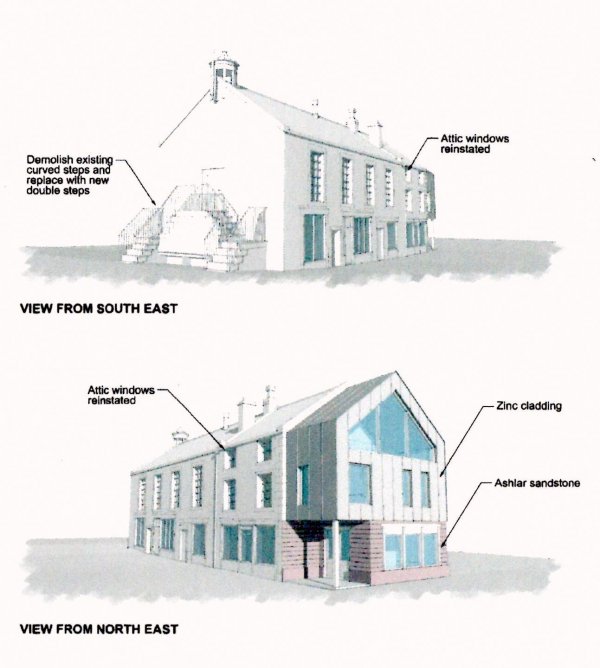

Architect's impression of the proposed extension of Appleby Moot Hall

Appleby Town Council are consulting over options for the historic sixteenth century Moot Hall all of which involve building a modern extension. However, in my view none of them are consistent with good conservation and none would achieve the objectives of the Heritage Action Zone. I have therefore written to the Town Council to register my objections.

To view or download a copy of my response to their consultation please click here