Apr 28th 2020, 14:27

Blog 28th April 2020

In this blog, I refer to local authority housing finance; coronavirus; economic development & procurement; local government finance; Local Government Association; Scottish Housing Regulator; Scottish housing associations; Training and Webinars.

Today, I am finalising my preparations for the ‘Introduction to Local Authority Housing Finance in England’ webinars that I will be holding tomorrow, Thursday and next week. They have proved very popular and I am looking forward to meeting the delegates. However, if you would like to join us, there are still places available. For further information or to make a booking, please click here.

I had some interesting conversations about procurement with a Council Leader and a Housing Association Chief Executive last week.

There will be a need to re-start the economy after the coronavirus pandemic; and especially in areas with low incomes and / or high unemployment, one issue will be finding ways to ensure that resources stay within the area rather than being ‘leaked’. Local authorities, housing associations and other public bodies are major players in the local economy and should therefore have a part to play. For example, studies (especially in Scotland and Wales) have shown that the way housing associations manage their procurement can have a beneficial effect on the local economy and therefore advantage their tenants (whether as contractors, employees of contractors or just members of the community).

I think it is important that local enterprises (especially small to medium local enterprises) should have every opportunity to quote for work that becomes available especially from public and third sector bodies. The benefits would be:

However, in my experience, procurement policies are often too inflexible and bureaucratic, placing unnecessary obstacles in the way of potential contractors especially where they are small, medium or locally based enterprises. I have come across various unnecessary obstacles being placed in the way of small and medium local enterprises. For example, requiring contractors to prepare lengthy documentation for even small contracts; or requiring detailed policies to be submitted on a range of issues that are not relevant to the work in question; as well as asking for excessive amounts of insurance.

It seems clear to me that, if we want economic development programmes to be effective in retaining money in the local economy, we need an appropriate approach to procurement. I would not advocate giving work to any organisation other than that which offers the best value for money, but I think small and medium local enterprises may be best positioned to do that and therefore should not be excluded from quoting on unjustifiable grounds.

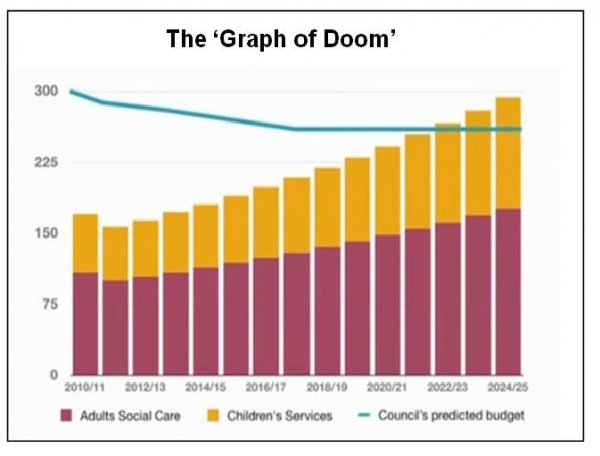

I wrote about the financial challenges that local government is facing because of the Coronavirus pandemic in my blog last week. These come on top of significant financial challenges that already existed, especially around funding adult social care and children’s services. The Local Government Association had already published their ‘Graph of Doom’ that shows that by 2022, local authorities in England will not be able to fund adult social care and children’s services adequately even if they were to discontinue all other services.

In this situation, a working knowledge of local government finance is surely required by councillors and non-financial managers in local government as well as finance staff!

I have just launched a series of webinars that provide an ‘Introduction to Local Government Finance in England’. These webinars give an introduction and overview of this important subject and are fully up to date with all developments. There are three webinars:

Each webinar will last about an hour and costs £30 plus value added tax (a total of £36).

These webinars are comprehensive and are designed for people who are not experts in local government finance in England, but who need to understand the basics and achieve an overview of what is going on. They are suitable for councillors, non-financial managers, finance staff who do not have experience of every aspect of local government finance and others who realise that an understanding of local government finance can place them at an advantage!

It is possible to ask questions during and after the webinar. Each webinar is also accompanied by a very useful briefing paper that will be emailed to participants after it has finished alongside a copy of the presentation used and a CPD Certificate. A recording of the webinar is also available after it is completed.

For further information or to make a booking, please click here.

For further information about all our webinars, please click here.

If you would like to enquire about future webinars, or would like to suggest any relevant subjects, please e-mail adrian.waite@awics.co.uk or telephone 017683-51498.

Last year, the Scottish Housing Regulator reported that Housing Associations were financially robust and were making progress towards achieving the Scottish Government’s targets for the development of new social housing. They noted that:

Headquarters of the Hebridean Housing Partnership in Stornoway

Whether Scottish housing associations will still be in such a strong position when they emerge from the coronavirus crisis remains to be seen, but in any event, a working knowledge of Scottish housing association finance will surely be an advantage to all those involved in Scottish housing associations.

During the last week, we have published two new briefing papers on Scottish Housing Association Finance. These describe how the revenue and capital aspects of housing association finance in Scotland work. To view or download them, please click the links below:

We also published a briefing paper on English local authority housing finance. To view or download it, please click the link below: