Jun 9th 2021, 11:32

Blog 9th June 2021

In this blog I consider the poor financial resilience of English local authorities. This results from underlying factors and government policy as well as coronavirus. Clearly, the ‘fair funding review’ should be concluded and should give councils more resources and autonomy. However, I fear the government will opt for continued constraints on core funding and increased reliance on specific grants distributed in an arbitrary way.

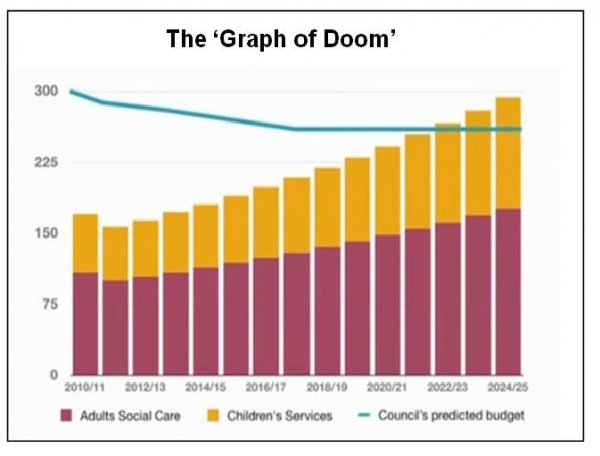

The National Audit Office has found that a third of British local authorities are at medium to high risk of financial failure. It is tempting to think that this is because of the coronavirus pandemic and that the situation will improve as rates of infection fall, restrictions are lifted, and the economy returns to pre-pandemic levels of output. However, this is not the case. The pandemic has simply worsened a situation that was already perilous. In 2018/19 the Chartered Institute of Public Finance & Accountancy published its resilience index that showed that 10% of authorities were at high risk and during 2019/20 authorities withdrew £0.8billion from reserves to support revenue expenditure. Before this, the Local Government Association published its infamous ‘graph of doom’ that showed that, by the middle of the decade, councils would not have enough resources to fund social care services let alone anything else.

The 'Graph of Doom'

The pandemic has done nothing to reduce the pressure on budgets for adult social care and children’s services; and has increased the pressure on services including mental health and domestic abuse. It has also reduced Councils’ income with no guarantee that levels of income will recover to pre-pandemic levels soon.

One problem that Councils faced before the pandemic was reduced income from business rates as consumers switched their expenditure from the high street (where business rates are high) to online (where business rates are low). The pandemic has accelerated this trend and it is generally expected that this shift in consumer behaviour will be permanent. Many councils have also invested in town centre shopping centres that are no longer looking like sound investments. This shift in consumer spending has also reduced car parking income that is of critical importance to the finances of many councils.

Rob Whiteman, the Chief Executive of the Chartered Institute of Public Finance & Accountancy, points out in the ‘Public Finance’ magazine that:

“Covid19 has distorted the nature of local government. With the sector having been in permanent crisis mode for the past twelve months, officers are working to short-term planning horizons and sources of funding. There can be no doubt that this has compromised the financial resilience of councils across the UK. And while it would be unfair to say that all Councils are at a fiscal cliff edge, most are camped on the headland.

“Covid 19 has rightly brought many local government services to the forefront of political and public conversations in the UK. Any work to improve these services will rely on improving the financial resilience of the sector. Local government finances have never been as fragile as they are today.

“The pandemic has allowed government to delay reform of local authority finances but has only increased the scale of change needed.”

And Meg Hillier MP (Hackney South & Shoreditch, Labour), the Chair of the Public Accounts Committee has said that:

“The national pandemic has thrown up many challenges for local councils, not least that parts of Whitehall did not always work with them when drawing up national schemes. The Ministry for Housing, Communities & Local Government did step up to stave off a wave of council bankruptcies as a result of the pandemic, but the long-term health of the sector is still precarious. The over-optimism about the resilience of the sector is very concerning. The Ministry for Housing, Communities & Local Government needs to be a better champion for local government within Whitehall.”

Prior to the pandemic the government launched the ‘fair funding review’. This started with a consultation in December 2017. The fair funding review was intended to set new baseline funding allocations for local authorities by delivering an up-to-date assessment of their relative needs and resources, using the best available evidence. As part of this the government considered a wide range of options for developing an updated funding formula by looking again at the factors that drive costs for local authorities. I was pleased to assist with this by assisting in the preparation of financial models. To find out more about the role that AWICS played, please click here.

However, the ‘fair funding review’ has yet to conclude with the government putting it off twice, firstly because of ‘Brexit’ and secondly because of the coronavirus pandemic.

There is clearly a need to conclude the ‘fair funding review’ soon.

Rob Whiteman’s thoughts for the ‘fair funding review’ are that:

“The current system is heavily centralised and funding for services is overly reliant on property taxes. If local councils are to maintain their current services, or deliver more through devolution, those responsibilities should be met with a wave of necessary funding reforms that provide access to a plurality of additional funding sources.”

I agree with this, but fear that, judged in the context of the evolution of policy on local government finance, the government’s approach may be different.

The Comprehensive Spending Review of 2010 made significant changes to the financing of local government. Alongside significant reductions in central government support for local government came the principle of ‘localism’. This meant that ring-fenced grants, of which there used to be many, were all mainstreamed into the Revenue Support Grant giving councils the responsibility for deciding where budget reductions should be made. This enabled central government to claim the credit for reducing expenditure in total while avoiding responsibility for specific reductions in budgets that were often unpopular.

At first, Council Tax was ‘frozen’ thus increasing the pressure on local authority budgets; but later Council Tax was increased in real terms to enable councils to continue to fund social care despite the ongoing reductions in the Revenue Support Grant.

The Copeland Centre in Whitehaven where Copeland Council is based and where I used to be Finance Director and then Strategic Director - one of the 'left behind' areas

The result has been a reduction in public services, especially in the ‘left behind’ areas where social problems are the most common but reductions in funding have been largest. Government has presented this as a failure by local authorities and has launched a ‘levelling up’ agenda that is based on providing specific grants in what appears to be an arbitrary way.

I would like to see local authorities funded adequately and able to take real decisions at the local level about the appropriate level of taxation and expenditure and on what the priorities for that expenditure should be. For example, in my blog of 2nd February I advocated the replacement of business rates with a Commercial Landowner Levy. To view this blog, please click here.

However, I fear we will see a continued squeeze on the core resources of local authorities and a continued reliance on specific grants based on national political priorities and distributed in a way that lacks transparency.

We will be holding webinars entitled ‘Introduction to Local Government Finance in England’ during June and July. There are three webinars covering revenue, capital, and technical issues. For further information or to make a booking, please click here.

We have a wide programme of webinars on subjects of interest to those who care about public services including local government and housing. For further information, please click here.